(Photo by Karolina Grabowska via Pexels)

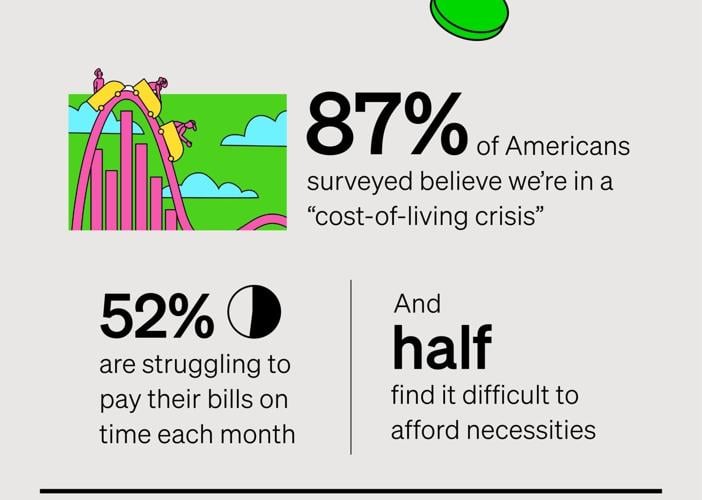

Nine in 10 Americans believe we’re in a “cost-of-living crisis,” according to new research.

The survey, which polled 5,000 Americans, split evenly by state and generation, revealed 87% agreed that the U.S. is in a “crisis” due to the lack of affordability.

This is visible in that half of Americans surveyed are struggling to pay their bills, like rent, on time each month (52%) or afford necessities, like groceries (50%).

And the cost-of-living crisis doesn’t appear to be going anywhere: almost eight in 10 (78%) said “everything” became more expensive in 2025, and 46% believe throughout 2026, things are going to become even less affordable.

Commissioned by Current and conducted by Talker Research, the survey looked at how feelings of affordability have impacted respondents — specifically, in where they’re living.

Thirty-eight percent of respondents have moved because where they were living became too expensive — with younger generations much more likely to have done so (51% of Gen Z vs. 19% of baby boomers surveyed).

(Talker Research)

Across generations, about a third of these respondents moved to a different city (38%) or to a different state altogether (34%) to lower their cost of living.

Due to the lack of affordability, about half of respondents don’t believe they’ll ever be able to live in their “ideal” city (52%) or state (48%). Again, this was much higher among younger respondents — 64% of Gen Z said they won’t be able to afford their ideal city, compared to just 35% of boomers.

“With the prices of everyday essentials still elevated and costs of living climbing, Americans are feeling a real affordability crisis,” said Erin Bruehl, VP of Communications, Current. “When half of Americans say they are struggling just to keep up with monthly bills and expect costs to keep rising, they need financial solutions more than ever that can help them make the most of every dollar and provide access to much-needed liquidity.”

As a result of the high cost of living, some Americans are looking toward their taxes as an option for relief.

Half of respondents are expecting to receive a refund after filing their taxes, and of those, 73% admitted they need their refund this year more than ever before, due to the rising cost of living.

Sixty percent of respondents expecting a refund also need their refund earlier than ever before. This was especially true for younger respondents, with 74% of Gen Z admitting they need their refund earlier than ever, compared to 34% of baby boomers.

(Photo by Karolina Grabowska via Pexels)

The majority of those respondents (58%) believe their refund will be a “meaningful” amount — which they defined as at least $2,100.

Respondents plan to use their refund wisely, with the vast majority going toward necessities (27%), savings (24%) and paying down debt (24%).

“Fun spends,” like vacations, account for only 11% of their planned refund, showing respondents’ focus on responsible spending.

“Tax refunds are often the biggest checks many Americans receive each year and now more than ever, they are a critical source of liquidity that people are not only counting on, but are in need of earlier than ever,” said Bruehl. “They’ve become lifelines to pay down debt and avoid missed payments and late fees. With their timing now mattering as much as the size of the refund it is a clear signal that Americans need partners who can get them access to their money as quickly as possible.”

(Photo by Towfiqu barbhuiya via Pexels)

HOW DO RESPONDENTS PLAN TO USE THEIR TAX REFUND?

- Necessities (groceries, gas, etc.) — 27%

- Savings or investments — 24%

- Paying down debt/paying back debt (student loans, credit card debt, etc.) — 24%

- Fun spends (vacations, going to events, etc.) — 14%

- Other — 11%

(Photo by Nicola Barts via Pexels)

WHAT PERCENT OF RESPONDENTS SAID THEIR STATE IS “AFFORDABLE”?

- Hawaii — 12%

- Alaska, Colorado — 14%

- Connecticut — 16%

- Rhode Island — 17%

- New Jersey — 21%

- Oregon, Massachusetts — 23%

- Maine, Nevada, Vermont — 24%

- California, Illinois, New York — 27%

- New Hampshire, Pennsylvania, Utah — 28%

- Washington — 30%

- Maryland — 31%

- Florida — 32%

- Montana — 37%

- Minnesota — 38%

- North Carolina — 39%

- New Mexico — 40%

- Arizona — 41%

- Virginia — 42%

- Georgia, Michigan — 43%

- West Virginia, Wisconsin — 44%

- Idaho — 45%

- Indiana, Louisiana — 49%

- Delaware, Wyoming — 50%

- Nebraska — 51%

- Tennessee — 52%

- Kansas, Kentucky — 53%

- Arkansas, North Dakota, Ohio, South Carolina — 54%

- Missouri, South Dakota, Texas — 56%

- Iowa — 57%

- Oklahoma — 60%

- Alabama — 61%

- Mississippi — 62%

Research methodology:

Talker Research surveyed 5,000 Americans state by state (100 in each state) who plan to file taxes, split evenly by generation (1,250 Gen Z, 1,250 millennials, 1,250 Gen X, 1,250 baby boomers), who have access to the internet. The survey was commissioned by Current and administered and conducted online by Talker Research between Dec. 17, 2025 and Jan. 5, 2026. A link to the questionnaire can be found here.

To view the complete methodology as part of AAPOR’s Transparency Initiative, please visit the Talker Research Process and Methodology page.

(0) comments

Welcome to the discussion.

Log In

Keep it Clean. Please avoid obscene, vulgar, lewd, racist or sexually-oriented language.

PLEASE TURN OFF YOUR CAPS LOCK.

Don't Threaten. Threats of harming another person will not be tolerated.

Be Truthful. Don't knowingly lie about anyone or anything.

Be Nice. No racism, sexism or any sort of -ism that is degrading to another person.

Be Proactive. Use the 'Report' link on each comment to let us know of abusive posts.

Share with Us. We'd love to hear eyewitness accounts, the history behind an article.